Large insurance companies with plenty of liquid capital can use rebating to drive smaller less financially viable insurance companies out of business creating a monopoly in which. Its a term used in theinsurance industryto describe the process of returning a portion of an insurance premium to the policyholder with the desire to induce an insurance sale.

Fabric Flower Bouquet Fabric Flower Bouquet Fabric Bouquet Fabric Flowers

Rebating can be done in various ways including cash back discounts on future premiums or refunds.

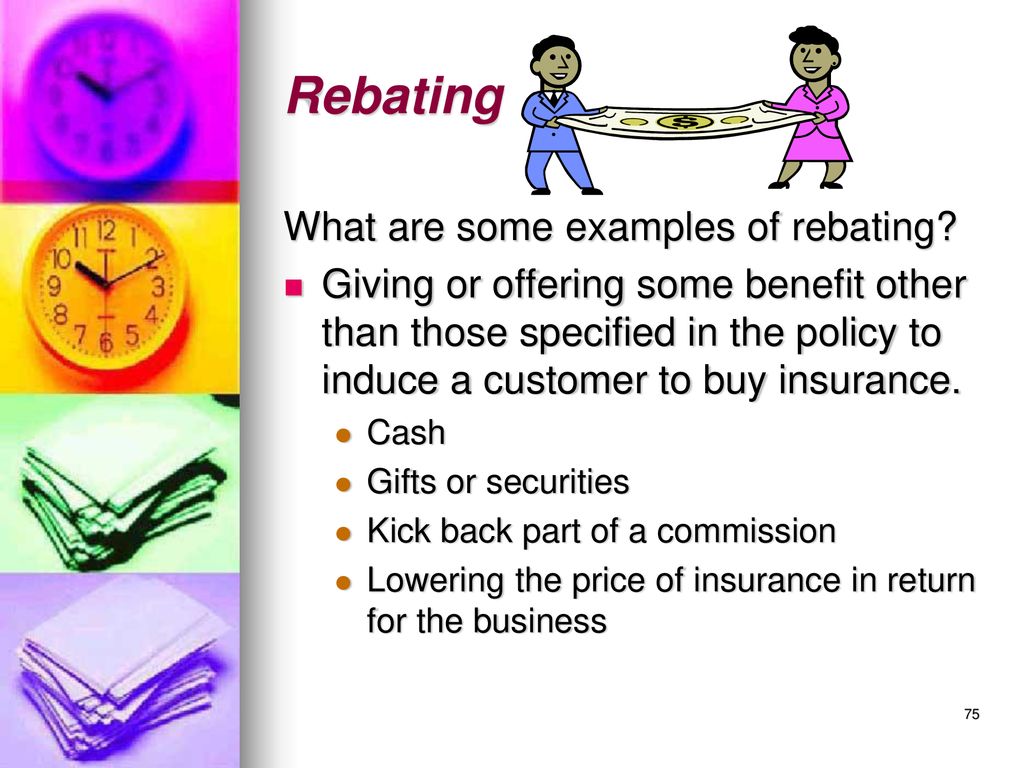

. Rebating is the practice of providing cash rebates or expensive gifts to potential insurance clients in order to induce them to purchase an insurance policy. Written by Chris Tepedino. Rebating is illegal in most states and provinces and carries with it hefty fines and penalties.

Rebating is illegal in most states because it can allow for unfair competition or inadequate customer coverage. Rebating in insurance is the act of an agent offering to pay part of their commissions to a policyholder as an incentive to buy from them. There are a short and simple answer and a longer explanation.

The short answer is Additional value provided by insurance agents which are not in the policy and it is not available for other customers. However the rebating laws allow giving something of value where it is specified in the insurance contract. In a reciprocal insurance exchange or reciprocal inter-insurance exchange the company is owned by its policyholders but managed by a separate entity called an attorney-in-fact AIF who has power of attorney for the company.

Reciprocal insurance exchange definition. Reciprocal insurers are unincorporated groups of people that agree to insure each others. Most states define insurance rebating as an offer or inducement an agentbroker uses to get a prospective customer to buy an insurance policy where the inducement falls outside of the features of the life insurance contract.

For insurance companies providing a rebate to customers on the purchase of an insurance policy can lead to multiple problems including these two distinct issues. Still sometimes consumers can face trouble as well. In the insurance business rebating is a practice whereby something of value is given to sell the policy that is not provided for in the policy itself.

In a nutshell this means that twisting and rebating in insurance is the practice of paying a commission to an agent for their services. Lets see the definition. In life insurance rebating is when the insurance agent who is selling you the policy gives up their commission on the sale applying it instead directly to your life insurance policy or as a direct cash-value rebate.

Rebating can also be referred to as inducement. What is rebating in insurance. Definition Rebating returning a portion of the premium or the agentsbrokers commission on the premium to the insured or other inducements to place business with a specific insurer.

Written by Alison Tobin Managing Editor of Features and News Reviewed by Leslie Kasperowicz. Thanks to a historic state budget surplus Georgia residents who have filed both their 2020 and 2021 tax returns will be eligible to receive rebate payments based on. Punishment typically falls on the company or agent who offered the rebate.

A rebate is any incentive that an insurance agent broker or company offers to coerce a customer into signing on to a policy. Rebating is illegal in the majority of states. Typically the rebate is received in the form of a check which you can either invest in the policy of insurance.

Free Insurance Comparison Secured with SHA-256 Encryption Home What is rebating in insurance. A report from the Kaiser Family Foundation has found that 82 million health insurance policyholders should be entitled to a piece of a 1 billion pool of rebate funds this fall. This practice is illegal as it creates unfair competition.

Rebating is when an insurance company refunds part of the premium or a portion of the agentsbrokers commission to the insured or other incentives to acquire a business with a certain provider. The rebate is typically funded by the insurance agent. Rebating is the practice of returning the brokers commission or a portion of it to the insured with the desire of inducing an insurance sale.

What is rebating in insurance.

What Is Rebating In Insurance Definition Risks Pros And Cons

B C Regulator Publishes Premium Rebating Guidance For Insurance Licensees Insurance Portal

Why Regulators Should Dump Anti Rebating Laws

Currin Compliance Services Inc Rebates Gifts Inducements

Design Book Cover For Real Estate Educational Book Book Cover Contest Design Book Cover Picked Book Cover Design Ebook Cover Book Design

Ohio Insurance Agents Association Inc Ohio S Rebating Laws Undergo Big Changes

![]()

A Nikon Example Of Why I Hate Rebates Connecting The Dots

Rebates Nondiscrimination And Compensation Alaska Division Of Insurance Public Meeting November 13 Ppt Download

New Naic Rules Could See Explosion In Carrier Freebies Insurance Business America

What Is Rebating In Insurance Yrfc Org

California Pushes Back On Naic Rebate Friendly Amendments To Century Old Model Act Stone Dean Law

What Is Rebating In Insurance Policy Advice

Insurance Rebating Everything You Need To Know Insurance Pro Blog

Rebate Vs Discount What Are The Differences Enable Blog

The Check S In The Mail Mlr Premium Rebate Checks And What Do We Do With Them Bbg Inc